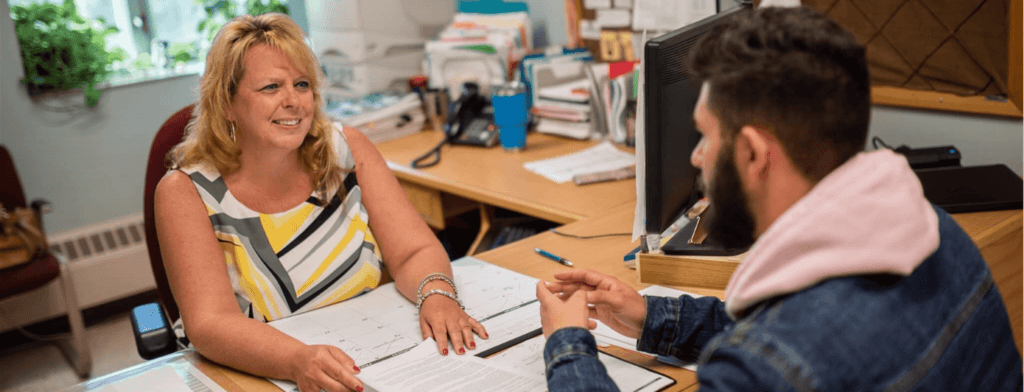

Paying for college can be confusing, but NHTI makes it simple!

Your education is an investment to last a lifetime. Our Financial Aid Office is committed to working with you to secure eligible funding so you can achieve your goals.

A few things you should know before getting started:

- You have to apply for financial aid each academic year.

- You have to be matriculated (formally accepted) into a financial aid-eligible program (16 credits or more).

- Every matriculated student could be eligible for federal aid.

You should also consider:

CCNSH’s Promise Program helps N.H. students who qualify based on financial need by bridging the gap between grants, scholarships, and the cost of tuition and required comprehensive fees at all 7 of New Hampshire’s community colleges.

Contact Financial Aid at 603-230-4013 to see if you are eligible.

Every semester thousands of dollars in scholarships and grants goes unrewarded simply because no one applies for them! In some cases, all these funds need is one qualified applicant. Do not underestimate the importance and convenience of scholarships and grants in helping to offset your NHTI tuition.

As an NHTI student, you can apply for our extensive list of AwardSpring scholarships with just a single application!

You may be eligible for work-study opportunities at NHTI if you have documented financial need and checked the box on the FAFSA form for work study.

Once you’ve been approved, you can visit any number of on-campus departments always looking for help. These include Student Life, Campus Safety, and Athletics – and they pay $14/hour!

Contact Financial Aid at 603-230-4013 to see if you are eligible. If you are an in-state student, you may be eligible for state-funded Community College Work-Study funding.

Federal Direct Stafford loans are fixed-rate student loans that do not require you to make any payments until 6 months after you leave college or reduce your course load below 6 credit hours.

Parents’ Loan for Undergraduate Students (PLUS) allows parents of dependent students to borrow in their own name through the Federal Direct Loan Program to help meet educational expenses. Click here for more information: www.studentaid.gov

Private Educational loans may be available to you once you have exhausted all federal and state aid options. Consider a private educational loan.

Cohort default rate is the percentage of a school’s borrowers who enter repayment on certain Federal Family Education Loan (FFEL) Program or William D. Ford Federal Direct Loan (Direct Loan) Program loans during a particular federal fiscal year (FY), Oct. 1 to Sept. 30, and default or meet other specified conditions prior to the end of the second following fiscal year. The U.S. Department of Education releases official cohort default rates once per year. The NHTI most recent cohort default rate/repayment rate is 2.0%.

Federal Financial Aid

Your FAFSA will be emailed to us automatically. Our Financial Aid Office will review it to determine your eligibility for funding. Some students may be randomly selected for verification. If you are selected, you’ll receive an email and or letter from the Financial Aid Office.

Net Price Calculator

As a guide for early college financial planning, this tool provides an estimate of your net cost to attend NHTI if you are a full-time student seeking a first-time undergraduate degree.

Additional Resources

The Financial Aid Office is required by federal regulations to periodically review financial aid recipients to ensure that they are making academic progress towards the completion of their program of study. Satisfactory academic progress for financial aid recipients is measured by both qualitative and quantitative standards and is an assessment of a student’s cumulative academic record while in attendance at the institution.

| Qualitative – Cumulative GPA (CGPA) Component: Must have earned the required CGPA at the published intervals |

| Quantitative – Pace (Completion Rate) Component: Must complete at least 67% of the credits attempted, rounded to the nearest percent. |

| Quantitative – Maximum Time Frame Component: Must complete the program of study within 150% of the time frame allowed |

In general, coursework that is taken while in attendance at the CCSNH institution is considered when reviewing a student’s academic record for satisfactory academic progress. However, there are some exceptions. Please see the section on Treatment of Repeated Courses, Audited Courses, Incompletes, Developmental/Remedial Courses, English as a Second Language Courses (ESOL), Credits by Examination, Non-punitive Grades, Pass/Fail Grades, and Withdrawals.

Qualitative Standard – Cumulative GPA (CGPA) Component

A student must maintain a minimum cumulative grade point average as noted below in order to make satisfactory academic progress. A GPA calculator is available at

https://www.ccsnh.edu/admissions/gpa-calculator/.

Quantitative Standard – Pace (Completion Rate Component) and Maximum Time Frame Component

The quantitative standard of the satisfactory academic policy is comprised the following two elements:

- Pace (Completion Rate Component): A student must complete at least 67% of the total credits he/she attempted throughout his/her academic career at the college, rounded to the nearest percent. All attempted credits, including transfer credits, will be included in the quantitative calculation. For example, a student who has attempted 36 credits at the college must earn credit for at least 24 credits in order to meet the requirements of satisfactory academic progress.

- Maximum Time Frame Component: In order to be eligible for federal student aid, students must complete the program of study within 150% of the time frame allowed. For example, a student enrolled in a 60 credit degree program must complete the program before exceeding 90 attempted credits. Developmental and remedial classes may be excluded from the 150% calculation. Throughout enrollment, as soon as it can be determined that a student is not on target to graduate within 150% of the standard program length, financial aid will be suspended. Students may be identified and suspended as they reach the 150% time limit, but the college understands there are situations such as enrollment for a second or subsequent degree, a change of major, or the non-applicability of transfer credit that could result in a student needing a reset of the Quantitative – Maximum Time Frame Component. For example, for a student who changes majors, only coursework attempted that is applicable to the new program of study may be counted in the maximum time frame.

Once it has become apparent a student will be unable to complete their academic program within the maximum time frame, either by falling below the pace standard or by having attempted 150% of the credits required to complete their academic program, the student becomes ineligible for Title IV aid.

Academic Periods Included in the Review

The qualitative and quantitative standards of the Satisfactory Academic Progress policy will be used to review the academic progress for all periods of the student’s enrollment. Even periods in which the student did not receive federal student aid will be included in the review. Additionally, periods for which the student was granted academic amnesty will be included in the review.

Timing of the Review

The Financial Aid Office of the CCSNH institution will evaluate a financial aid recipient’s satisfactory academic progress upon completion of each semester within the academic year of the program the student is enrolled in.

Results of the Review Meeting

- Satisfactory Academic Progress (SAP): Standards Students who meet SAP standards will be coded as making Satisfactory Academic Progress and will retain eligibility for federal student aid for the next semester of enrollment.

- Satisfactory Academic Progress (SAP) Warning: Students who do not meet SAP standards will be placed on SAP warning for one semester. Students placed on SAP warning will retain eligibility for federal student aid for the warning semester. At the end of the warning period, SAP standards will be reviewed. If the student meets SAP standards, he/she will be coded as making Satisfactory Academic Progress and retain eligibility for federal student aid for the next semester of enrollment. If the student is still unable to meet SAP standards, he/she will be ineligible for federal student aid at the institution until he/she is able to meet SAP standards or granted Probation.

- Satisfactory Academic Progress (SAP) Suspension: If the student is still unable to meet SAP standards after his/her Warning Period, he/she will be ineligible for federal student aid at the institution until he/she is able to meet SAP standards or has been granted Probation.

- Satisfactory Academic Progress (SAP) Probation: A student who becomes ineligible for federal student aid may appeal for a review of that determination. If the appeal is granted, a student is assigned Probation status. Generally, all students must have an academic plan if he/she requires more than one semester to reestablish financial aid eligibility. During Probation, the student is eligible to receive federal student aid.

Appeal Process

A student who becomes ineligible for federal student aid may appeal for a review of that determination. The student appeal request and any supporting documentation or degree audit must be submitted to the Financial Aid Office. A successful appeal results in Probation and allows the student to be eligible for federal student aid for his/her probationary period.

A student choosing to submit an appeal of his/her SAP review results may be requested to submit the following information to the Financial Aid Office:

- A written explanation of the circumstances that prevented him/her from achieving SAP standards, documentation of any extenuating circumstances, and what has changed in his/her situation that will allow him/her to achieve satisfactory academic progress unless the situation was evident. The Financial Aid Appeals Committee reserves the right to request further information from the student to support information provided in his/her explanation.

- An academic plan which the student will follow to regain satisfactory academic progress.

- If a student changes curriculum programs, is working toward multiple degrees/certificates, or graduates and enrolls in a second degree and then reaches 150% of the credits required for the new degree (or primary degree/certificate in the case of multiple degrees/certificates), a degree audit or academic plan may be requested with the appeal and will be evaluated on an individual, case-by-case basis.

Regaining Eligibility

Unless an appeal is granted, a student can regain financial eligibility only by taking action that brings him/her into compliance with both the qualitative and quantitative components of the CCSNH institution’s Satisfactory Academic Progress policy. If a financial aid recipient believes he/she is meeting Satisfactory Academic Progress standards, then he/she can request to have his/her SAP standing reviewed upon completion of the semester. If the student is found to be meeting both the qualitative and quantitative components of the SAP policy and to not have exceeded maximum time frame, then his/her status will be updated to reflect he/she is meeting Satisfactory Academic Progress standards, and the student will be eligible to receive Title IV financial aid the next semester.

If you are accepting federal loans for the first time at NHTI, you will also need to complete the required MPN on-line at https://studentaid.gov/mpn/ and Entrance Counseling at https://studentaid.gov/entrance-counseling/ NHTI will be notified electronically in approximately 48 hours.

Students who have received a federal subsidized, unsubsidized or PLUS loan(s) are required to complete Exit Counseling each time they drop below half-time enrollment, graduate, or leave school. Exit counseling provides important information on how to manage your student loan repayment, including your rights and responsibilities as a borrower.

You will need your US Department of Education FSA ID (this is the same FSA ID you used to file your FAFSA). If you do not remember your FSA ID or password, you may recover these at Studentaid.gov by clicking log in, use email or phone and forgot my password. Here will direct you to redo password.

To complete the counseling process, log in at studentaid.gov

- Click on “Loan Repayment

- Click on “Loan Exit Counseling” and Log In To Start

How to Apply Your Financial Aid

Financial aid can be used as an acceptable payment arrangement only if the FAFSA application for the current school year and all NHTI financial aid requirements are completed prior to the tuition due date. To verify that you have completed all of your financial aid requirements and that you have enough financial aid to cover your balance due, please do the following:

- Be sure that all of your financial aid requirements are met:

- Log into your SIS

- Select Financial Aid

- Choose Financial Aid Status

- Select Campus

- Select the Aid Year you wish to view

- If you have any outstanding requirements that need to be completed, you will see a message “You have unsatisfied student requirements for this aid year” displayed. Click on the link to view the requirements.

- Verify that your Financial Aid will cover your tuition charges:

- Log into your SIS

- Select Financial Aid

- Select Award Offer

- Select Award for Aid Year

- Select Campus

- Select the Aid Year you wish to view

- Select Award Overview

- Scroll down to Financial Aid Award by Term

- If you have been awarded financial aid, the amount of your aid for the term will be displayed here. Deduct your estimated total amount of your award for the term from your tuition charges.

NOTE: Students that do not have their financial aid in place by the tuition due date may get assessed a $50.00 late fee to their account.

If you have questions about your financial aid, please contact our Financial Aid Office at [email protected] or 603-230-4013.

NHTI is required to provide information published by the U.S. Department of Education to you any time information on loan availability is provided. If we enter into an agreement with you or your parent regarding a Title IV, HEA loans are required to inform you that the loan will be submitted to the National Student Loan Data System (NSLDS) and accessible by guaranty agencies, lenders, and schools determined to be authorized users of the data system.

Chat Live with Us!

Contact Us:

[email protected]

603-230-4013

Fax: 603-230-9306

Monday-Thursday, 8 a.m.-4:30 p.m.

Friday, 8 a.m.-4 p.m